The good news? You don’t need a finance degree to teach your children valuable money lessons. With some simple jars, age-appropriate chores, and a few strategic games, you can set your kids up with financial skills that will benefit them for life. Let’s explore how to make money lessons fun, engaging, and effective for even the youngest learners.

The Power of Early Financial Education

Children as young as three can grasp basic money concepts like saving and spending. By age seven, many kids can understand that money is finite and requires choices. And by ten, they’re ready for more complex ideas like interest and delayed gratification.

Teaching money lessons early helps kids:

- Develop healthy money habits before bad ones can form

- Build confidence in making financial decisions

- Learn patience and planning skills

- Understand the connection between work and rewards

- Prepare for increasing financial responsibility as they grow

The key is making these lessons age-appropriate and fun. Kids learn best through hands-on experiences and real-world examples, not lectures about compound interest or budget spreadsheets.

Earning Money — Chores That Teach Responsibility

One of the first money lessons kids should learn is that money comes from work. Setting up a simple chore system that “pays” for completed tasks helps children make this connection while teaching responsibility.

Age-Appropriate Chores for Young Kids

Ages 4-6:

- Putting away toys

- Feeding pets with supervision

- Helping sort laundry

- Watering plants

- Making their bed (with help)

Ages 7-10:

- Taking out small trash bags

- Folding and putting away clothes

- Setting and clearing the table

- Light dusting and sweeping

- Helping prepare simple meals

It’s important to distinguish between “paid chores” and “family responsibilities.” Some tasks should be done simply because everyone contributes to the household, while others can earn allowance. This teaches both responsibility and work ethic.

Saving Money — The 3-Jar System

The 3-jar system is one of the most effective tools for teaching kids about money management. This simple approach divides money into three categories: Save, Spend, and Give.

How the 3-Jar System Works:

SAVE (40-50%)

For long-term goals and bigger purchases. This teaches patience and planning.

SPEND (40-30%)

For immediate wants and small purchases. This teaches decision-making.

GIVE (20%)

For helping others or causes they care about. This teaches generosity.

When your child receives money—whether from allowance, birthdays, or other sources—help them divide it among the three jars. Clear containers work best so kids can visually see their money growing, especially in the “Save” jar.

For younger children, physical jars work best. As they get older, you can transition to a digital system or a more sophisticated budgeting approach, but the physical act of dividing money is powerful for young learners.

Money Games & Activities That Make Learning Fun

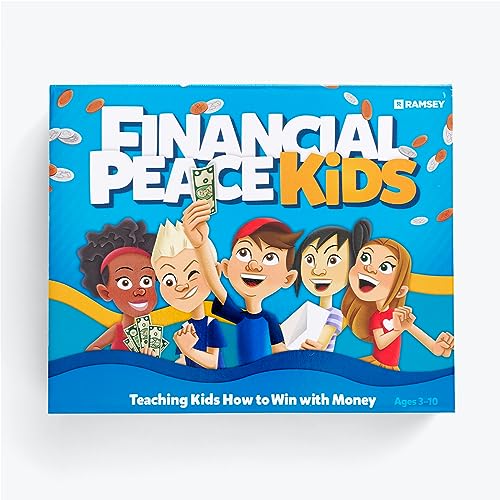

Games are perhaps the most effective way to teach kids about money because they don’t feel like they’re learning—they’re just having fun! Several excellent board games and activities can reinforce financial concepts while keeping children engaged.

Board Games That Teach Money Skills:

For Ages 5-7:

- Monopoly Junior

- The Allowance Game

- Money Bags Coin Value Game

- Exact Change

For Ages 8-10:

- Monopoly

- Pay Day

- Cash Flow for Kids

- Money Bingo

Fun Money Activities Beyond Games:

- Grocery store math: Give your child a small budget at the store and help them calculate what they can buy within that amount.

- Lemonade stand: Help them set up a simple business to learn about profit, loss, and customer service.

- Coin sorting races: Make identifying coins fun by turning it into a timed challenge.

- Money story problems: Create real-life math problems involving saving and spending scenarios.

Shopping Lessons — Understanding Value

The grocery store is a perfect classroom for teaching kids about money. These real-world experiences help children understand concepts like comparison shopping, needs versus wants, and finding value.

Simple Shopping Activities:

- Unit price comparisons: “This cereal is $4.50 for 18 ounces, and this one is $3.75 for 12 ounces. Which is the better deal?”

- Budget challenges: “We have $10 to spend on fruit. Let’s see what combination gives us the most.”

- Sale hunting: “This item is 30% off. How much will we save? Is it worth buying now?”

- Needs vs. wants sorting: Before checkout, review the cart and discuss which items are necessities and which are extras.

For younger children, you can simplify these activities. Even a 5-year-old can understand that they can buy either one big toy or three smaller toys with the same amount of money.

Setting Simple Savings Goals

Teaching kids to save for specific goals is one of the most powerful money lessons they can learn. It builds patience, planning skills, and helps them understand delayed gratification—a crucial skill for financial success.

How to Set Age-Appropriate Savings Goals:

- Choose something meaningful: Let your child select something they genuinely want that costs more than their regular spending money.

- Make it visible: Use a chart, picture, or progress tracker to visualize their progress.

- Keep timeframes reasonable: For younger kids, goals should be achievable within 4-8 weeks. Older children can work toward longer-term goals.

- Celebrate milestones: Acknowledge when they reach 25%, 50%, and 75% of their goal to maintain motivation.

- Avoid bailouts: Resist the urge to “help” them reach their goal too quickly—the waiting and working is where the learning happens.

Lead By Example — Modeling Money Management

Children learn more from what we do than what we say. When it comes to money lessons, your own financial habits speak volumes. Creating opportunities for your kids to observe healthy money management in action is perhaps the most powerful teaching tool available.

Ways to Model Good Money Habits:

- Talk through purchases: “I’m buying this on sale because we save money when we can, even though I could afford the full price.”

- Show comparison shopping: “I’m checking three different stores to find the best price on this item.”

- Demonstrate delayed gratification: “I’m waiting until next month to buy this because I want to save a bit more first.”

- Include kids in budget discussions: Have age-appropriate conversations about family financial goals.

- Be honest about mistakes: “I regret buying this without researching it first. Next time I’ll be more careful.”

Remember that kids notice everything—including your relationship with money. If you’re constantly making impulse purchases while telling them to save, they’ll follow your actions rather than your words.

Age-Specific Money Lessons Before 10

While all children develop at different rates, here are some general guidelines for age-appropriate money lessons:

Ages 3-4

- Identifying coins and bills

- Understanding that things cost money

- Learning to wait (basic delayed gratification)

- Distinguishing needs from wants

Ages 5-7

- Making simple coin combinations

- Using the three-jar system

- Earning money for simple chores

- Making basic spending choices

- Understanding advertising basics

Ages 8-10

- Making change and calculating costs

- Saving for medium-term goals

- Comparison shopping

- Basic budgeting concepts

- Introduction to banks and interest

The key is meeting your child where they are developmentally. Some 6-year-olds might be ready for concepts typically taught to 8-year-olds, while some 9-year-olds might still be mastering earlier skills. Patience and consistency are more important than following a strict timeline.

Building a Foundation for Financial Success

Teaching kids about money before age 10 isn’t about creating mini-accountants or future Wall Street traders. It’s about laying a foundation of healthy money habits that will serve them throughout life. The goal is to raise children who understand that money is a tool to be managed wisely, not something to fear or worship.

Remember that consistency matters more than perfection. Even small, regular money lessons—counting coins while waiting in line, discussing why you chose one product over another, or celebrating when they reach a savings goal—add up to significant financial literacy over time.

By starting early with these simple money lessons, you’re giving your child a gift that will benefit them long after they’ve outgrown their piggy banks and chore charts. Financial confidence is a skill that lasts a lifetime.

This post may contain affiliate links, which means we might earn a small commission (at no extra cost to you) if you decide to make a purchase through one of these links. Thanks for your support!