Why Rent Out Your Space on Airbnb?

Before diving into the how-to, let’s explore why so many homeowners are choosing to rent out their space on platforms like Airbnb:

Financial Benefits

- Generate additional income to help with mortgage payments

- Earn more than traditional long-term rentals (up to 2-3x more in popular areas)

- Offset property costs during periods you’re not using the space

- Create a flexible income stream you can adjust based on your needs

Lifestyle Advantages

- Maintain control over your property’s availability

- Meet interesting people from around the world

- Keep your space for personal use when needed

- Build hospitality skills that transfer to other areas

💡 Pro Tip: Many successful hosts start by renting out their space part-time during peak travel seasons or local events to test the waters before committing to year-round hosting.

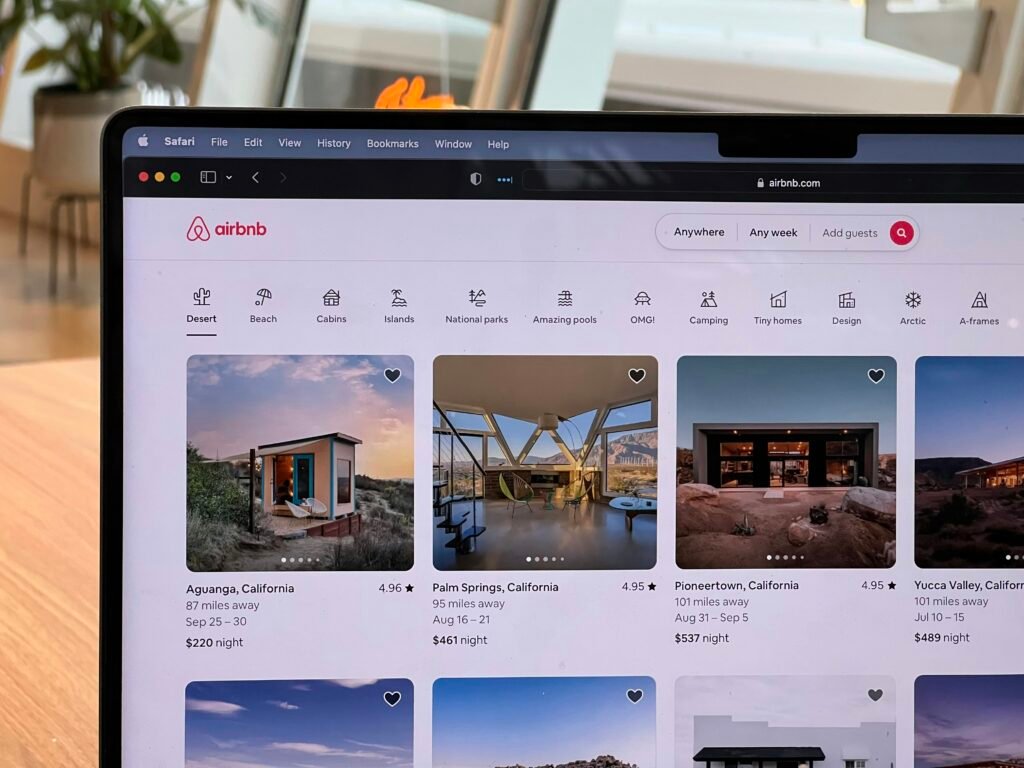

Platform Comparison: Where to Rent Out Your Space

While Airbnb is the most recognized name in short-term rentals, it’s not the only option. Understanding the differences between platforms can help you choose the best fit for your property and goals.

| Platform | Commission Fee | Target Audience | Best For | Special Features |

| Airbnb | 3% host fee | All travelers, especially millennials | Any type of space, including shared rooms | Superhost program, Experiences |

| Vrbo | 5% + 3% payment processing | Families and groups | Entire homes and private spaces | Premier Partner program |

| Booking.com | 10-15% | International travelers | Properties in tourist destinations | Genius loyalty program |

| Local Platforms | Varies (often lower) | Region-specific travelers | Properties in niche markets | Local expertise and support |

Ready to start hosting?

Sign up today and create your first listing in minutes!

Many successful hosts list on multiple platforms to maximize visibility and bookings. Consider starting with one platform to learn the ropes, then expanding your presence once you’re comfortable with the process.

Legal & Safety Checklist Before You Rent Out Your Space

Before you list your property, it’s crucial to understand the legal landscape and safety requirements for short-term rentals in your area.

Legal Considerations

- Local regulations: Check your city’s zoning laws and short-term rental ordinances. Many cities require permits, licenses, or registrations.

- HOA and lease restrictions: If you’re in a condo or apartment, review your HOA rules or lease agreement for rental restrictions.

- Tax obligations: Understand your responsibility for collecting and remitting occupancy taxes, as well as reporting rental income.

- Landlord permission: If you’re renting, you’ll need written permission from your landlord before subletting on Airbnb.

Insurance Requirements

Standard homeowners insurance typically doesn’t cover short-term rental activities. Make sure you’re protected with the right coverage:

Platform Protection

- Airbnb’s AirCover (up to $1M damage protection)

- Vrbo’s damage protection ($1M liability insurance)

- Note: Platform protection has limitations and shouldn’t be your only coverage

Additional Insurance Options

- Short-term rental insurance

- Business owner’s policy

- Umbrella insurance for additional liability

Protect your investment

Get specialized short-term rental insurance coverage today.

💡 Pro Tip: Create a separate LLC for your rental business to add an extra layer of liability protection between your personal assets and your rental activities.

Preparing Your Space for Guests

Creating a welcoming, comfortable environment is essential for positive reviews and repeat bookings when you rent out your space on Airbnb.

Essential Amenities

Bedroom

- Quality mattress and bedding

- Extra pillows and blankets

- Blackout curtains

- Bedside lamps and charging stations

Bathroom

- Clean towels (2 per guest)

- Basic toiletries (soap, shampoo)

- Hair dryer

- First aid kit

Kitchen & Living Areas

- Coffee maker and basic supplies

- Cookware and utensils

- Smart TV with streaming services

- Reliable WiFi

Safety Features

Ensuring guest safety is non-negotiable when you rent out your space:

- Smoke and carbon monoxide detectors on each floor

- Fire extinguisher in an accessible location

- Emergency contact information

- Secure locks on all doors and windows

- Well-lit entrances and walkways

💡 Pro Tip: Install a smart lock system to provide unique access codes for each guest, eliminating the need for physical key exchanges and improving security.

Optimization Hacks to Maximize Your Rental Income

Once your space is ready, these strategies will help you stand out from the competition and maximize your earnings when you rent out your space on Airbnb.

Pricing Strategies

Setting the right price is crucial for maximizing occupancy and revenue:

- Research comparable listings in your area to understand the market rate

- Implement seasonal pricing to capitalize on high-demand periods

- Offer weekday discounts to increase occupancy during slower periods

- Consider length-of-stay discounts for weekly or monthly bookings

- Use dynamic pricing tools to automatically adjust rates based on demand

Optimize your pricing strategy

Try PriceLabs dynamic pricing to automatically adjust your rates based on demand, seasonality, and local events.

Staging and Photography Tips

Great photos are essential for attracting potential guests:

Staging Your Space

- Declutter and depersonalize

- Add tasteful decor and plants

- Ensure all lights work and use bright bulbs

- Stage functional areas to show their use

Photography Best Practices

- Shoot during daylight hours

- Use wide-angle lens (but avoid distortion)

- Capture all rooms and special features

- Consider hiring a professional photographer

Automation Tools

Save time and improve guest experience with these essential tools:

- Property management software to coordinate bookings across platforms

- Automated messaging for check-in instructions and follow-ups

- Smart home devices for remote monitoring and management

- Cleaning service coordination to ensure timely turnovers

💡 Pro Tip: Use automation tools like Hospitable to manage guest communications, send personalized messages, and coordinate cleaning schedules—all while saving hours of manual work each week.

Automate your hosting

Streamline your operations and save time with Hospitable’s automation tools.

Case Study: How Sarah Earns $2,800/Month with Her Spare Bedroom

Sarah, a marketing professional from Denver, was looking for ways to supplement her income without taking on a second job. After researching how to rent out your space on Airbnb, she decided to list the spare bedroom in her two-bedroom condo.

“I was hesitant at first about having strangers in my home, but the extra income has been life-changing. I’ve paid off my student loans and can now save for a down payment on a larger property.”

Sarah’s Strategy:

- Initial investment: $1,200 for new bedding, towels, smart lock, and professional photos

- Pricing approach: $89/night base rate with dynamic pricing during events and peak seasons

- Target guests: Business travelers and weekend tourists visiting Denver

- Unique selling point: Private bathroom and workspace for business travelers

- Time commitment: 5 hours per week for messaging, cleaning, and management

Monthly Results:

Revenue

- Average nightly rate: $95

- Average occupancy: 85%

- Monthly revenue: $2,800

Expenses

- Cleaning supplies: $50

- Utilities increase: $75

- Amenities/restocking: $100

- Platform fees: $84

Net monthly profit: $2,491

💡 Pro Tip: Sarah uses a separate business checking account for her Airbnb income and expenses, making tax time much simpler and helping track her rental property’s profitability.

Frequently Asked Questions About Renting Out Your Space

What if my guest damages my property?

Most platforms offer some form of protection. Airbnb’s AirCover provides up to $1 million in damage protection and liability insurance. Additionally, you can collect a security deposit and screen guests by reviewing their profiles and ratings. For valuable items, consider storing them securely or removing them entirely during guest stays.

How much time does it take to manage a short-term rental?

Time commitment varies based on your property and management approach. Expect to spend 2-5 hours per week on messaging guests, coordinating cleanings, and managing bookings. Using automation tools and property management software can significantly reduce this time. Some hosts also hire co-hosts or property managers to handle day-to-day operations.

Do I need to be present during guest stays?

No, you don’t need to be present. Many successful Airbnb listings are managed remotely. With smart locks, digital guidebooks, and automated messaging, you can provide a seamless guest experience without being physically present. If you’re renting a room in your home, you’ll naturally have more interaction with guests.

How do taxes work for short-term rentals?

Rental income must be reported on your tax return. However, you can deduct expenses related to your rental activity, including cleaning, supplies, insurance, and a portion of your mortgage interest and property taxes. Keep detailed records of all expenses. Some areas also require you to collect and remit occupancy or tourist taxes. Consult with a tax professional familiar with short-term rentals.

Can I rent out my primary residence while I’m away?

Yes! Many hosts rent out their primary residence when they travel. This is an excellent way to offset vacation costs or make your home work for you when it would otherwise sit empty. Just make sure to secure valuables, create clear instructions for guests, and have a local contact person available in case of emergencies.

million in damage protection and liability insurance. Additionally, you can collect a security deposit and screen guests by reviewing their profiles and ratings. For valuable items, consider storing them securely or removing them entirely during guest stays.

How much time does it take to manage a short-term rental?

Time commitment varies based on your property and management approach. Expect to spend 2-5 hours per week on messaging guests, coordinating cleanings, and managing bookings. Using automation tools and property management software can significantly reduce this time. Some hosts also hire co-hosts or property managers to handle day-to-day operations.

Do I need to be present during guest stays?

No, you don’t need to be present. Many successful Airbnb listings are managed remotely. With smart locks, digital guidebooks, and automated messaging, you can provide a seamless guest experience without being physically present. If you’re renting a room in your home, you’ll naturally have more interaction with guests.

How do taxes work for short-term rentals?

Rental income must be reported on your tax return. However, you can deduct expenses related to your rental activity, including cleaning, supplies, insurance, and a portion of your mortgage interest and property taxes. Keep detailed records of all expenses. Some areas also require you to collect and remit occupancy or tourist taxes. Consult with a tax professional familiar with short-term rentals.

Can I rent out my primary residence while I’m away?

Yes! Many hosts rent out their primary residence when they travel. This is an excellent way to offset vacation costs or make your home work for you when it would otherwise sit empty. Just make sure to secure valuables, create clear instructions for guests, and have a local contact person available in case of emergencies.

Start Your Hosting Journey Today

Learning how to rent out your space on Airbnb and other platforms can transform an underutilized property into a significant source of income. By following the steps in this guide, you’ll be well-equipped to navigate the world of short-term rentals and maximize your earnings potential.

Remember that successful hosting is a balance of providing exceptional guest experiences while protecting your property and maintaining profitability. Start small, learn from each booking, and continuously optimize your approach based on feedback and results.

Ready to start earning with your space?

Join millions of hosts worldwide who are turning their properties into profitable short-term rentals.

💡 Pro Tip: The most successful hosts are those who continually learn and adapt. Join host communities, attend webinars, and stay updated on industry trends to keep your listing competitive and profitable.